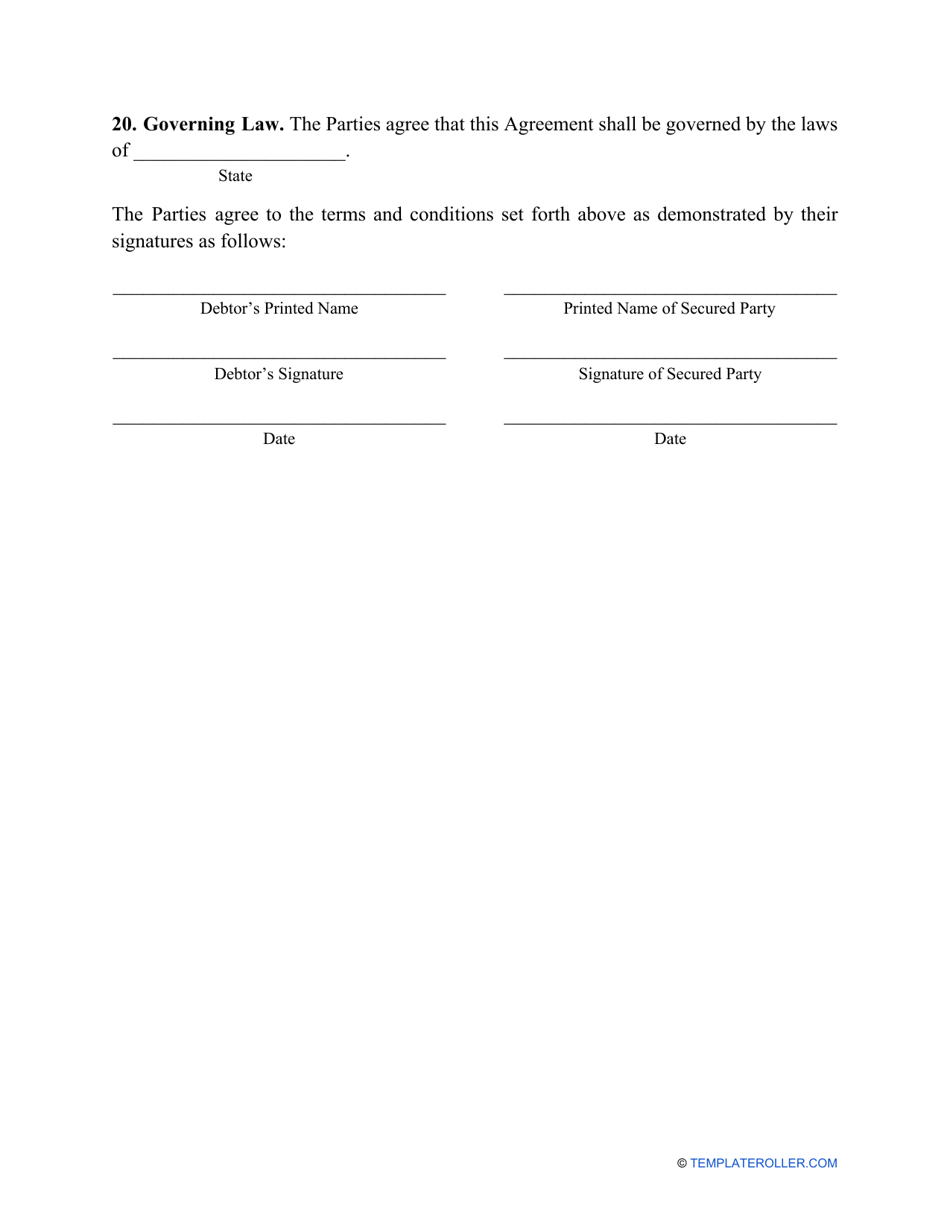

Security Agreement Template

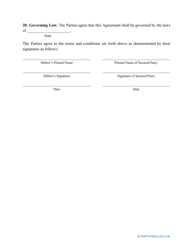

A Security Agreement is a formal document signed by the lender and the borrower - the latter provides their property or interest in an asset as collateral for the loan. Many financial institutions need more than the promise of the borrower and constant payments, and this financial tool allows them to secure their funds by taking the borrower's property in case they fail to repay their debt. You can download a printable Security Agreement template via the link below.

A debtor has a better chance to secure the loan and prove their creditworthiness to a creditor if they offer their assets as collateral - the lender can be more willing to provide them with funds for personal and commercial loans if they know they can cease the property of the debtor after delinquency. Then, the lender can sell the assets to recover the funds borrowed by the debtor and compensate for their financial loss.

ADVERTISEMENT

How to Write a Security Agreement?

Follow these steps to draft a Security Contract:

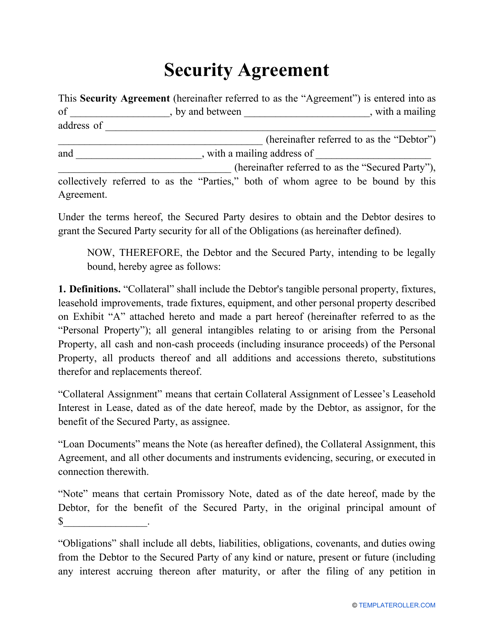

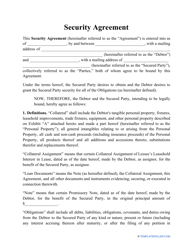

- Identify the parties - the debtor and the lender. Write their names and addresses. You may add other contact information for the convenience of counterparts who may need to remain in contact.

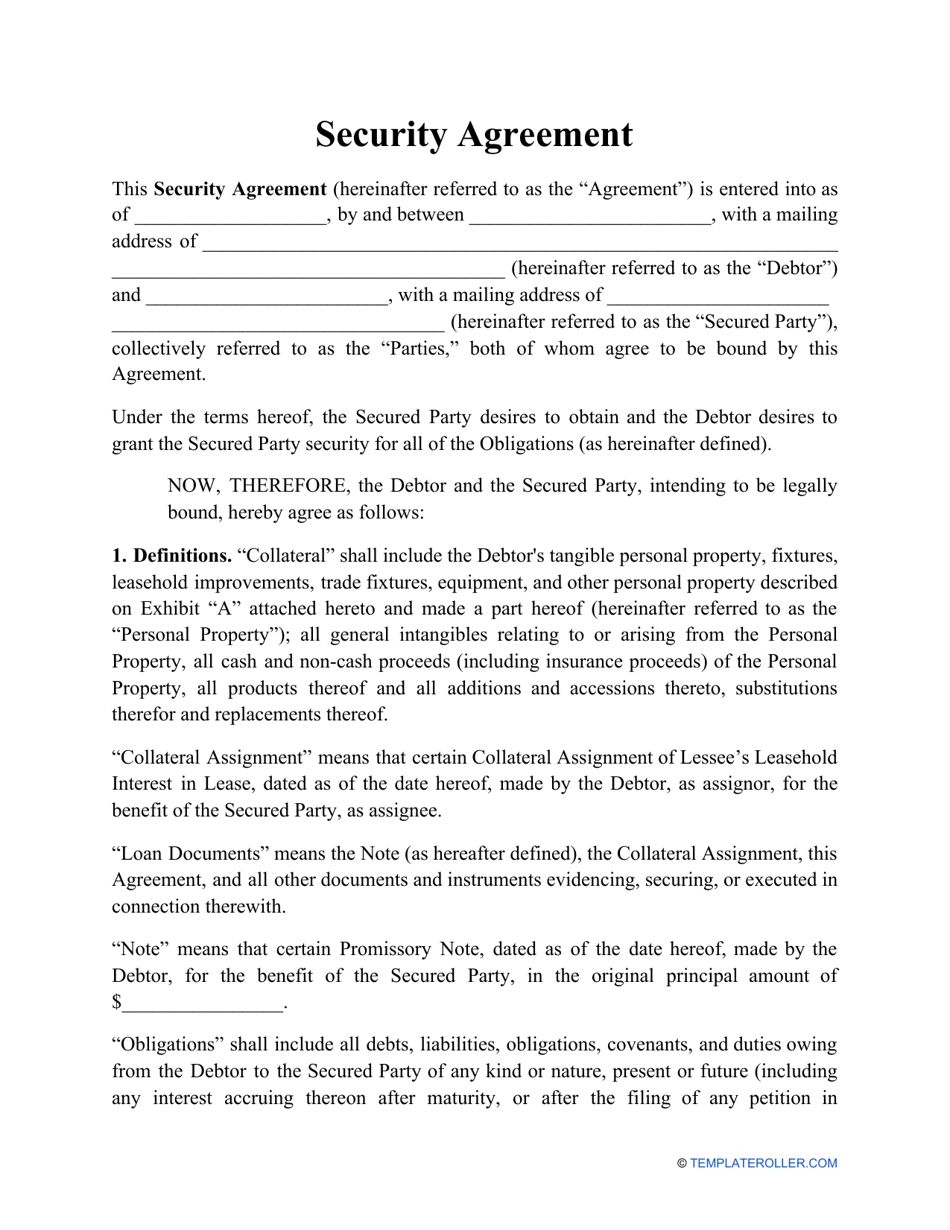

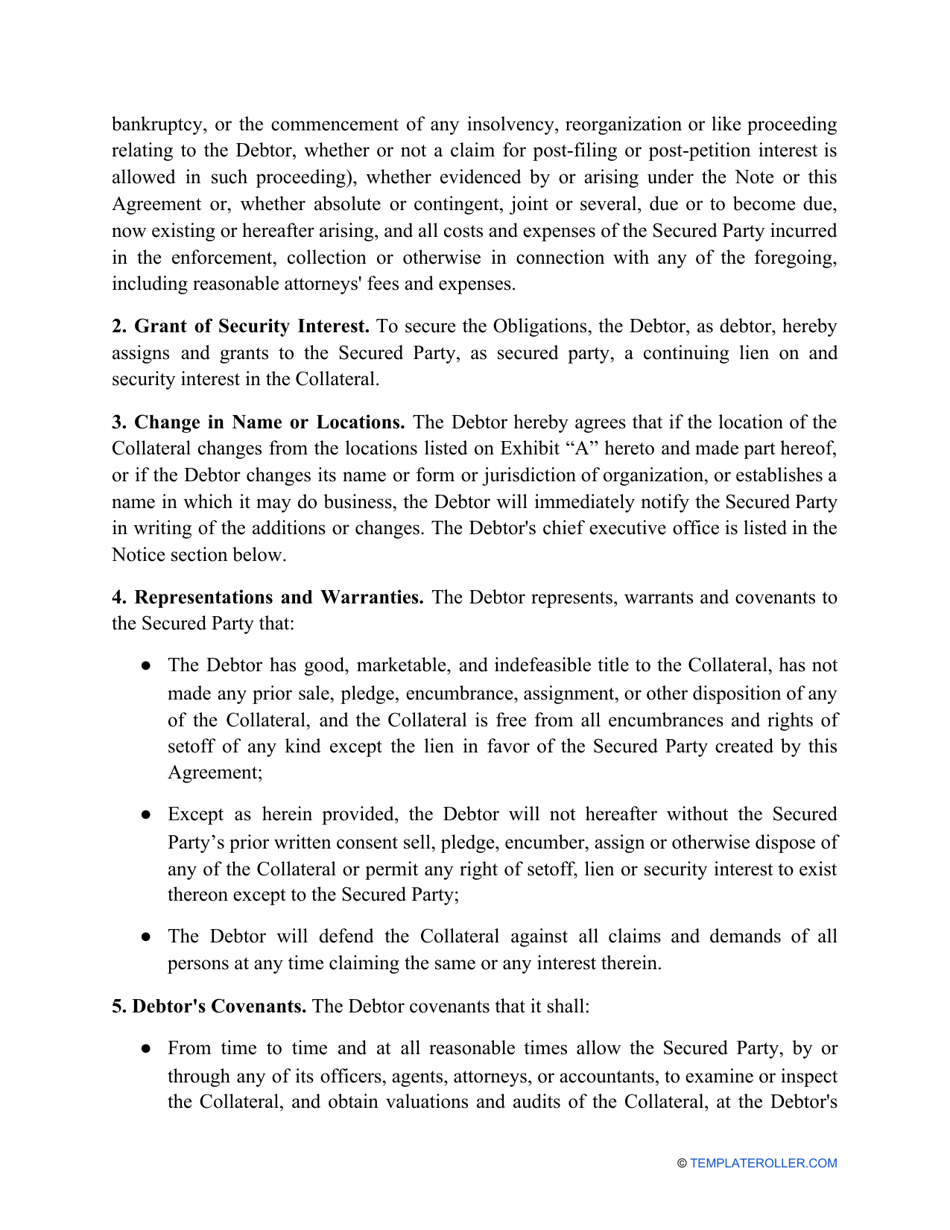

- Confirm that the debtor grants a security interest in the property to a lender. Describe the property - for instance, if it is a house, you have to write down its location the way it appears in legal documentation; record the main characteristics of the motor vehicle if you choose to pledge it as collateral. Note that you may choose between all kinds of property to determine proper collateral - this list includes but is not limited to equipment, financial instruments, investments, trademarks, intellectual property, etc.

- Explain that this arrangement secures a particular loan - identify it by the date and amount. Since most loans are documented in writing, refer to the existing documentation to avoid confusion.

- Indicate the debtor's commitment to the agreement - they must promise not to sell, license, lease, or otherwise transfer the collateral in question. This provision also includes the debtor's promise not to grant any third parties security interests or liens in the property which is to be kept in good condition. It is recommended that the lender inspects the property before the document is signed to attest to its current state. If the price of the collateral is high, it may be a good idea to obtain an insurance policy - offer this possibility to the lender if they have any doubts regarding the arrangement.

- Determine the default for the purposes of your agreement. You need to list all situations that qualify as a default - for example, the debtor fails to make a payment and does not contact the lender to provide them with a reasonable cause, so the lender has a right to take possession of the collateral.

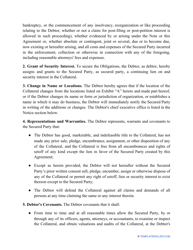

- Confirm both parties understand the contract in its entirety, sign and date the Security Agreement form.

Still looking for a particular form? Take a look at the related templates below:

- Credit Dispute Letter;

- Credit Denial Letter;

- Personal Guarantee.

Download Security Agreement Template

4.7 of 5 ( 15 votes )

1

2

3

4

5

6

7

8

Prev 1 2 3 4 5 . 8 Next

ADVERTISEMENT

Linked Topics

Security Interest Secured Transactions Loans and Credit Security Agreement Interest Rates Promissory Note Template Loan Agreement Form Terms and Conditions Personal Property Form Business

Related Documents

- Personal Guarantee Template

- Credit Denial Letter Template

- Credit Dispute Letter Template

- Security Incident Report Template

- Security Deposit Refund Letter Template

- Security Deposit Refund Request Form

- Security Deposit Refund Form

- Workplace Security Checklist Template

- Security Code Request Form

- Will the Explosion of Student Debt Widen the Retirement Security Gap? - Alicia H. Munnell, Wenliang Hou, and Anthony Webb - Center for Retirement Research

- Security Deposit Receipt Template

- Nist Risk Assessment Template

- It Risk Assessment Template

- HIPAA Risk Assessment Template

- Deposit Receipt Template

- Security Deposit Refund Form - Aqa

- New Vendor Setup Form - Dynamic Security Technologies

- Employer's Statement Form - Security Mutual Life Insurance Company

- Security Incident Report Form - North Central State College

- Security Awareness Report - Sans, 2017

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Split PDF

- Merge PDF

- Sign PDF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.